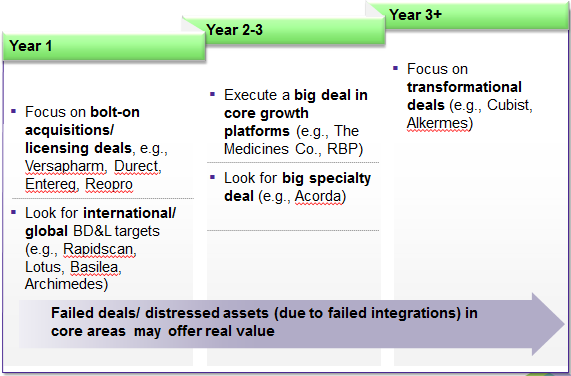

A slide from a presentation about what type of deals and growth a company should focus on over time.

The first section is titled "Year 1" and has two bullet points. The first bullet point is: "Focus on bolt-on acquisitions/licensing deals e.g. Versapharm Direct Enterea Reopro". The second bullet point is: "Look for international BD&L targets (e.g. Rapidscan Lotus Basilea Archimedes)."

The second section represents years 2-3 and also has two bullet points. The first bullet point is: "Execute a big deal in core growth platforms (e.g. The Medicines Co. RBP)". The second bullet point is: "Look for big specialty deal (e.g. Acorda)."

The third section represents year 3 and beyond. It has one bullet point which reads: "Focus on transformational deals (e.g. Cubist Alkermes)." The bottom of the page has a purple arrow point to the right that has the text "Failed deals/distressed assets (due to failed integrations) in core areas may offer real value." The arrow seems to indicate that the text applies to years 1 through 3+.

Type

-

Date

2014

Collection

We encourage you to view the image in the context of its source document(s) and cite the source(s) when using these images. However, to cite just this image alone, click the “Cite This Image” button and then paste the copied text.